So first how to understand the Petrodollar. Hundreds of oil tankers cross the world’s oceans each day with oil from Saudi Arabia and other countries in the Middle East priced in U.S.dollars or also known as Petrodollars.

The U.S. dollar or the Petrodollar has been the World Reserve Currency for roughly the last fifty years, before that the world reserve currency was the U.S. dollar but that was the U.S. dollar under the Bretton Woods System. The Bretton Woods System was the World Reserve Currency that was put in place after WW2 and that was backed by gold where each ounce of gold was redeemable for 35 dollars, the Petrodollar, on the other hand, is a fiat currency backed by Saudi Arabian oil and U.S. Treasury bonds priced in U.S.dollars, or known as Petrodollars.

The Petrodollar was the monetary system put in place to provide stability to the dollar after President Nixon ended the Bretton woods system on Aug 15, 1971.

Birth of the Petrodollar

In October of 1973, in response to the U.S. supplying weapons to Israel during the Yom Kippur War, Saudi Arabia proclaimed an oil embargo which caused oil prices to go up 5 times.

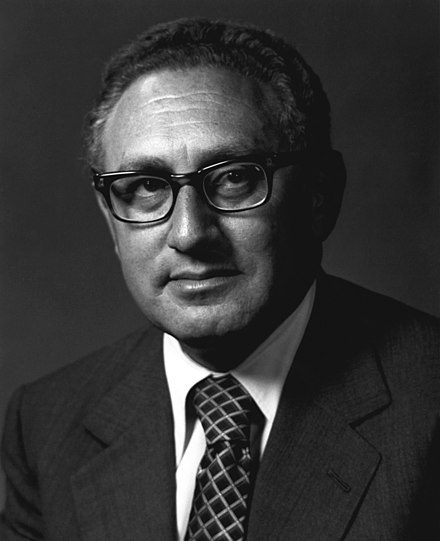

In response, in 1974 Richard Nixon asked Henry Kissinger and other White house foreign aids to go to Saudi Arabia and talk with the king of Saudi Arabia King Faisal to try and come up with a solution regarding the instability of oil prices and the lack of faith that nations had in the U.S. dollar.

The way the Petrodollar was set up was that the United States would provide military support and military weapons to Saudi Arabia, and in return, Saudi Arabia would price its oil in U.S. dollars and take their excess dollar reserves and purchase U.S. treasury bonds.

Saudi Arabia then convinced the other members of OPEC (Organization of the Petroleum Exporting Countries), to do the same.

Also in May of 1973, (S.W.I.F.T) Society for Worldwide Interbank Financial Telecommunication was founded to establish common standards for financial transactions. Now when any country traded around the world they first had to trade into U.S. dollars to purchase oil and other commodities under the guidelines laid out under (S.W.I.F.T).

The petrodollar established stability for the dollar for decades giving the U.S. the benefits that came with having the world reserve currency.

Backed by (S.W.I.F.T) and the U.S. Navy hundreds of oil tankers would receive middle eastern oil from Saudi Arabia and other OPEC nations. Protected by the Fifth fleet thru the Straight of Hormuz, and the southern seas of the Persian Gulf, Red Sea, Arabian Sea, and the Indian Ocean, and the sixth fleet north of the Suez Canal and into the Mediterranean and the Atlantic Ocean.

Until the year 2000, no OPEC country had dared violate the U.S. dollar pricing rule for oil as laid out under the guidelines set by (S.W.I.F.T).

But that all changed in October of 2000 when Saddam Hussein started selling Iraq oil in Euros. In March of 2003 two years later the Iraq War started, later that month the new Iraqi government announced that oil would once again be sold for dollars, and in 2006 Saddam Hussain was executed.

In 2010 Muammar Gaddafi announced an oil for Euros program, where he would price oil in Euros, one year later he was attacked by NATO aircraft and then finished off by Libya’s National Transitional Council (NTC) who beat him and bayoneted him to death.

In 2006 Syria left the Petrodollar and soon after in 2012 President Obama threatened war, but there wasn’t much public support for WW3 as Russia was one of Syria’s closest allies.

Twilight of the Petrodollar

In 2008, the U.S. decided to put sanctions on Iran, Iran in turn decided to come up with its own version of (S.W.I.F.T.) called (IOB) or International Oil Bourse. Iran and other nations soon started learning how trade could be done outside of the control of Petrodollars and the (S.W.I.F.T.) payment system using the (IOB).

Then in 2015, China came up with their version of (S.W.I.F.T) called (CIPS) or Cross-Border Interbank Payment System.

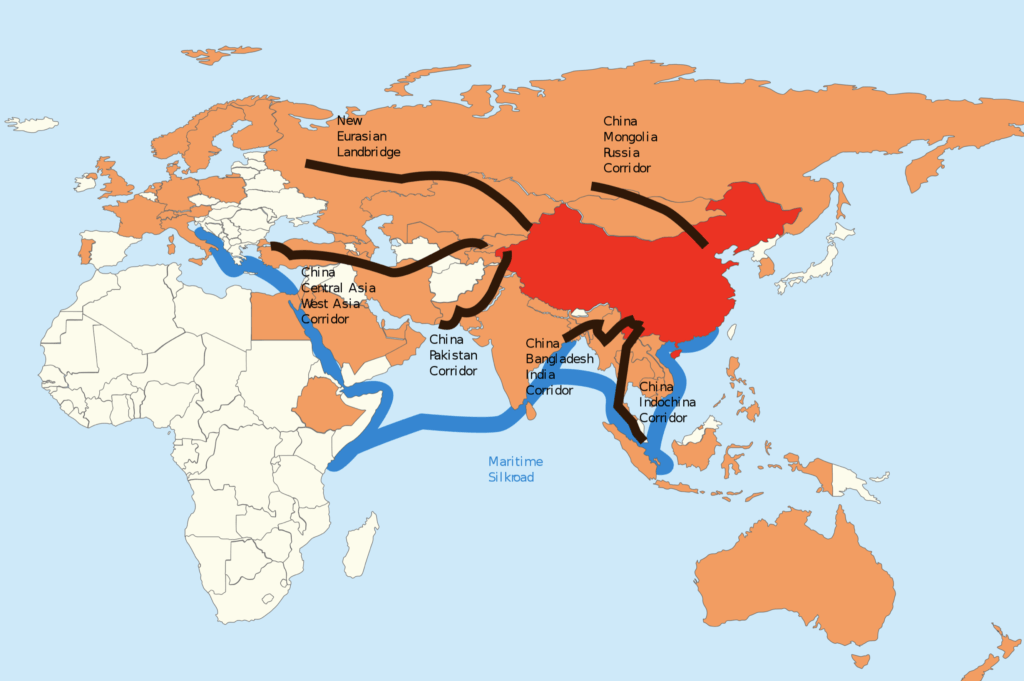

Also, in 2013 China started on what it would call the Belt and Road Initiative or One Belt One Road.

The Belt and Road is a series of railways, highways, and pipelines running beside the highways, that will connect China and Asia to the middle east and Europe, following the same historical routes as what’s known as the Old Silk Road. The Silk Road derived its name from the silk textiles that were made in China and sold in Europe via the Silk Road trade routes, the same roads and trade routes that Alexander the Great, Genghis Khan, and Marco Polo traveled.

However, this time it won’t be silk and spices but instead commodities such as oil and rare earth metals following the path of The Old Silk Road. And China doesn’t need the world’s largest Navy to secure the movement of its oil just the Belt and Road.

In August of last year, Saudi Arabia and Russia signed a military cooperation pact, and now China & Saudi Arabia are in active talks to price oil in Yuan. Nations around the world seem a little tired of American Hegemony, endless wars and the weaponization of the dollar where countries can abruptly find themselves on the wrong side of Uncle Sam and U.S. Greenbacks locked out of the (S.W.I.F.T.) payment system and with few means of doing trade.

Now it appears that we are at the end of the Petrodollar system, and in retaliation for Russia invading Ukraine, the U.S. and many of its allies imposed sanctions on Russia, despite the fact that President Putin was warning that he wouldn’t stand by and watch NATO put another military base on another bordering country, something he’s repeated many times over the last decade.

In response Russia was kicked out of (S.W.I.F.T) in February, also their Foreign Exchange Reserves were frozen.

With Russia now kicked out of (S.W.I.F.T.) this is just one more nail in the Petrodollars coffin as this will put massive pressure on the countries of Europe this fall and winter, where they can either cut ties with (S.W.I.F.T.) the U.S. and NATO and buy Russian oil and gas in Rubles or watch their citizens freeze and riot, more likely it will become a shell game of Russia selling oil and gas to China in Rubles, and Europe buying oil and gas in Yuan from China, this presents a massive logistics challenge trying to supply this quantity of oil and gas to Europe minus Russia and Ukraine’s pipeline infrastructure.

But more alarming for the U.S. is the lack of need for U.S. dollars as nations will no longer need them to do trade and we could see hyperinflation as the foreign exchange value of the dollar will likely plummet.

Events around the world are bringing a quick end to the old system. And nations around the world are learning how to do trade outside of (S.W.I.F.T.). This will mean much less demand for U.S. dollars or Petrodollars and much less demand for U.S. Treasury bonds.

This will likely not turn out well for most people, especially Americans who don’t understand what’s going on and have enjoyed the benefits that come from being citizens of the country that holds the world reserve currency. I recently wrote a book that explains what can be done to protect yourself. My book was designed to be a quick read and Chapter 6 explains how to prepare for the new monetary system.